Innovation in financing and business models for NBS. Why?

Cities are under pressure to address climate change challenges. The EC are proposing Nature-Based Solutions (NBS) as a cost-effective way of addressing climate change resulting in economic, social as well as environmental benefits.

But who is going to pay for NBS?

At present the business model and return-on-investment for NBS is not clear limiting interest from traditional financial institutions. Even for ‘patient’ impact investors the return-on-investment is often not clear enough to secure investment.

As a result the Naturvation Urban Nature Atlas shows that almost 75% of nature-based solutions are funded from public sources (public budget / direct funding or subsidies). Pressure on public finances is intense so what is the business case for investing in nature-based solutions over other competing public sector priorities? To attract alternative sources of investment what return on investment can nature-based solutions deliver? How should return-on-investment be measured - in monetary terms or also taking into account the environmental and social benefits accrued?

Pressure on public finances is not the only reason innovation in financing and business models for NBS is required. Open innovation/transition approaches to dealing with societal challenges recognise the benefits of engaging citizens and societal actors in creating solutions that respond to the specific challenges of their local environment and in designing solutions to meet these needs and environment. The role of government in this approach includes the articulation of user needs, co-creation of common vision, coordination of policies and tentative governance (Weber 2012, Kuhlmann and Rip 2014, Frenken 2017). Relational state theory goes a step beyond engaging societal actors in ‘building a common vision’ and ‘co-creating solutions’ and argues for ‘co-responsibility’ between the public sector and society in addressing today’s complex social problems like climate change ((Mendoza and Vernis 2008)). From the perspective of governance and business models of nature-based solutions these approaches present an important challenge. The public sector is required to facilitate an increase in the capacity of societal actors to engage more in the governance of nature-based solutions.

The Connecting Nature approach

Connecting Nature research has identified the following 6 major challenges to innovation in NBS financing and business models.

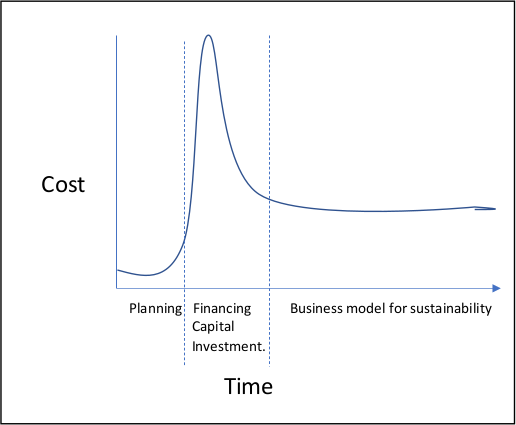

- Focus on capital investment without considering the sustainability of the NBS business model. Who’s going to pay for the NBS after the capital investment phase?

- Path dependency on the same sources of financing for NBS: NBS are mostly funded from public sources (city, regional, national, European). The pressure to meet disparate public funding requirements has led to the emergence of ‘Frankenstein’ projects not meeting the original NBS project objectives.

- ‘Silo’ gaps: Internally there is a lack of financial planning & business model expertise in the environmental and planning department. There is often a lack of alignment between public sector departments e.g. economic & tourist objectives v environmental & planning objectives. The interests of external stakeholders, beyond immediate residents, are often unexplored.

- Lack of experience in using public procurement to stimulate new innovations/markets.

- Pressure to pursue public-private partnerships without considering social or environmental trade-offs.

- Complexity of governance hindering innovation in business models: nature-based solutions often involve multiple public agencies, NGOs, residents and it is difficult to align different stakeholders to a common vision and engage stakeholders in ongoing governance and business model arrangements.

The Nature-Based Solutions Business Model Canvas

Trinity College Dublin, with feedback from the front-runner cities of Genk, Glasgow and Poznan have adapted the well-known business model canvas tool (Osterwalder & Pigneur 2010) to better capture the wider value proposition of nature-based solutions.

The Nature-Based Solutions Business Model Canvas helps to addresses the 6 major challenges to innovation in NBS financing and business models by:

- Reversing the focus on financing capital investment to start with business model planning for long term sustainability

- Broadening the value proposition to include a focus on environmental, social and economic benefits, the identification of new stakeholders and alternative ways of capturing value. This approach in turn may lead to the identification of new sources of financing.

- Bridging ‘silo’ gaps – both internally within public sector organisations and externally with different stakeholders. This helps to build a common vision & broader understanding of NBS potential for all stakeholders.

- The NBS Business Model Canvas facilitates capacity building and is supported by a comprehensive guidebook with multiple case-studies.

- Trade-offs between economic and other considerations are explored during the first step in the process of establishing the different value propositions.

- The NBS Business Model Canvas enables the clear identification of key stakeholders to be involved and consideration of how they can be engaged through different governance models.

Download the Nature-Based Solution Business Model Canvas and Guidebook

To receive a free copy of the Nature-Based Solution Business Model Canvas and Guidebook please send an email requesting same to: info@connectingnature.eu

Other resources

Naturvation Atlas & Business Model Catalogue

https://naturvation.eu/sites/default/files/results/content/files/business_model_catalogue.pdf

GrowGreen Catalogue of NBS Financing Approaches

http://growgreenproject.eu/wp-content/uploads/2019/03/Working-Document_Financing-NBS-in-cities.pdf